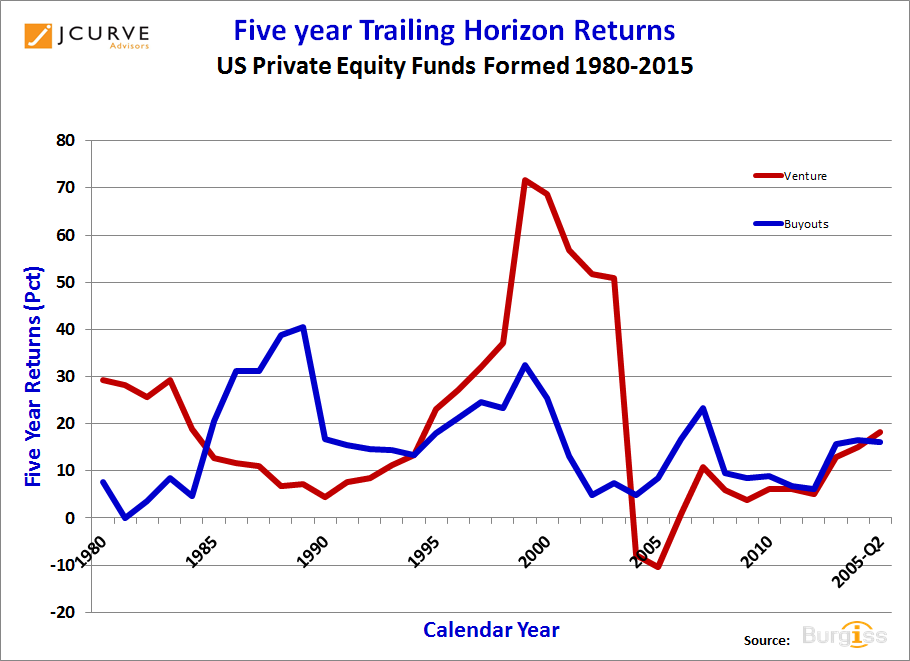

One of the well documented cyclical features of private equity and venture capital returns is that for most of their history, there has been an inverse correlation between the two asset classes. That is, when times are good for venture, they are not as good for buyouts and vice versa.

The rationale for this has been that buyouts depend on low prices to generate good returns and when venture returns are elevated, pricing is less than optimal for buyouts.

To demonstrate this, I’ve plotted data from Burgiss’ PrivateIQ returns database for the most recent 20 years merged with data from some of my prior research.

This data plots five year trailing returns for each asset class. — Why five years? I’ve been using this particular metric for at least the last 20 years as a good mid-point weighted barometer of each industry’s returns. It’s the end of the investment period for most limited partnerships and is the mid-point of the typical 10-year life fund.