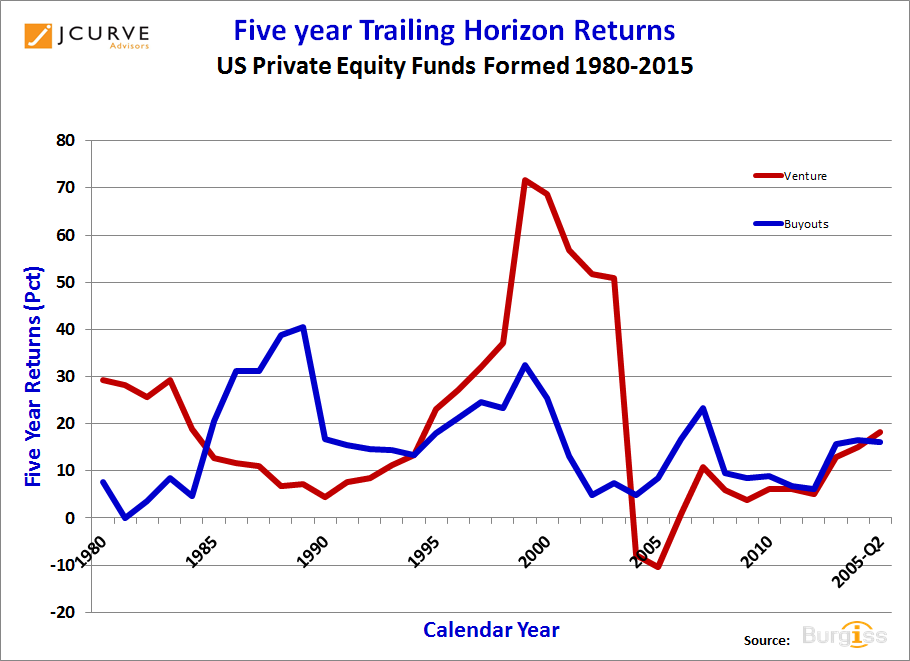

One of the well documented cyclical features of private equity and venture capital returns is that for most of their history, there has been an inverse correlation between the two asset classes. That is, when times are good for venture, they are not as good for buyouts and vice versa.

The rationale for this has been that buyouts depend on low prices to generate good returns and when venture returns are elevated, pricing is less than optimal for buyouts.

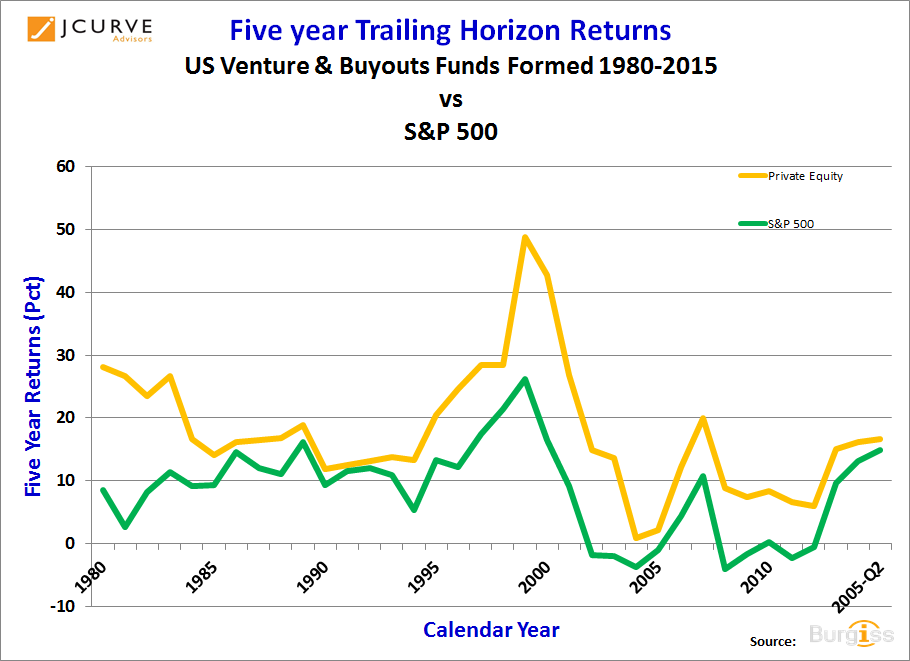

To demonstrate this, I’ve plotted data from Burgiss’ PrivateIQ returns database for the most recent 20 years merged with data from some of my prior research.

This data plots five year trailing returns for each asset class. — Why five years? I’ve been using this particular metric for at least the last 20 years as a good mid-point weighted barometer of each industry’s returns. It’s the end of the investment period for most limited partnerships and is the mid-point of the typical 10-year life fund.

The period from 1990s to the early 2000’s are marked by this inverse relationship. If you were a hedging type of investor or a diversified portfolio aficionado, this type of relationship makes the case for investing in both asset classes- you diversify some of the volatility away although you also attenuate the high returns that investors expect from their venture capital investments.

Since 2010, however there appears to be a higher positive correlation between the two asset classes and the counter-cyclicality of the asset returns series seems to have disappeared. In fact the mid-point returns for each asset class appear to be very similar.

Begs the question,: If I’m getting the same returns from each asset class, do i need to invest in both?

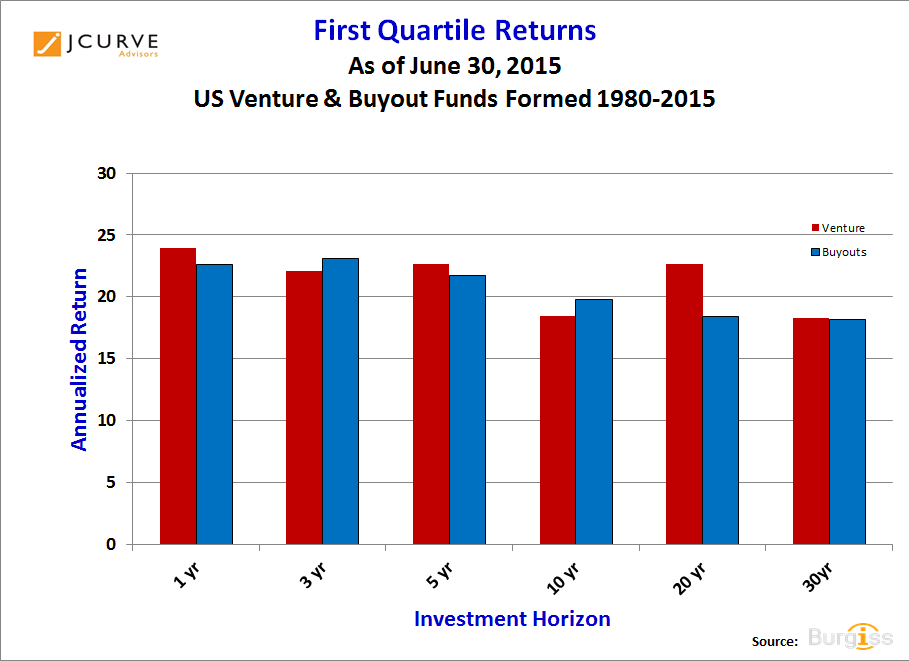

Examining first quartile returns as of June 30, 2015, the convergence appear to be more pronounced with little difference between venture and buyout returns on both a long-term and short term basis.

So if i’m investing for absolute returns as marked by “first quartile” funds, does it matter which asset class i pick — venture/ buyouts?

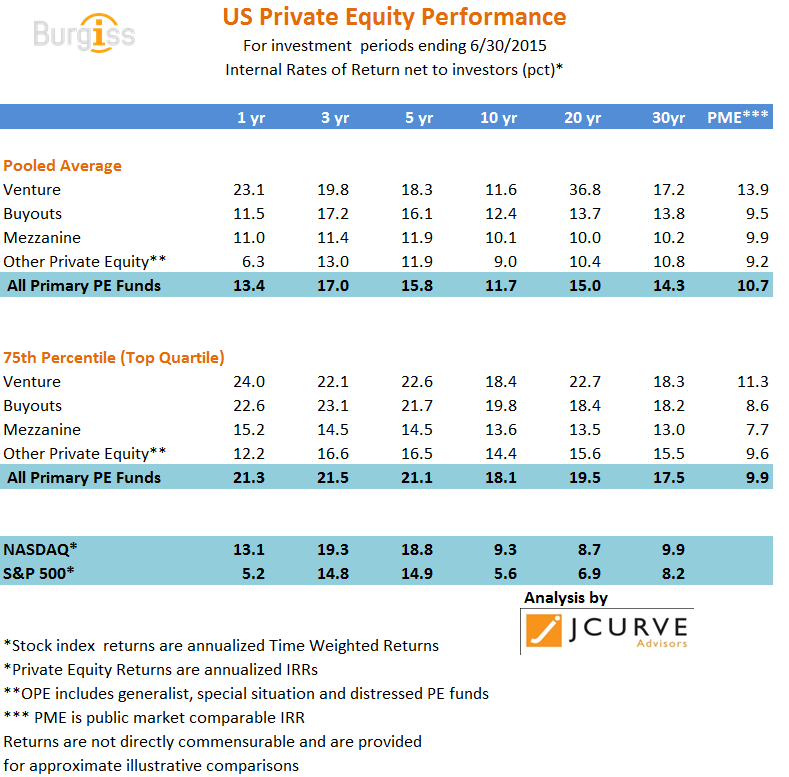

So let’s look at the most recent data on private equity performance as of 6/30/2015 courtesy of Burgiss.

Let’s examine the “pooled” averages — which are portfolio returns to each asset class. In the extreme short term, (one year, three year) venture capital returns have dominated private equity returns over the same period of time. In the longer term (5-10 year), except for the anomalous 36.8 percent venture return of 20 years, there is not a very large difference between the the two asset classes. It’s only when you examine the long-term returns that you see a marked difference.

Most likely the anomalous 36.8 percent 20-year return is most likely caused by a out-sized cashflow as evidenced that this return is above the top quartile return for the same period. Thus it shouldn’t be relied on as a typical venture return over the period.

For our purposes, as demonstrated above the five-year returns for venture and buyouts have converged with returns of 11.6 and 12.4 percent respectively.

So if short term and long term returns don’t show significant difference between venture and buyout funds on a first quartile difference but are markedly different on a pooled basis, what could be causing the five-year industry average return to convergin our first chart?

Some possibilities come to mind:

- There are no more pricing inefficiencies between the two asset class post-FASB 157 and it’s “marked-to-market” valuation mandate.

- The five-year period we are currently measuring (6/30/2010 to 6/30/2015) is a post-financial crisis period that might be differentiated by highly-correlated asset pricing convergence. That both asset classes are now highly correlated with public markets and thus develop correlation between each other because they are both correlated with a third asset class.

- Closely related–The public market bull market has “raised the tide” for all ships and thus attenuated any differentiation between the two asset classes in terms of valuation and entry/exit prices.

To test this public market effect. Let’s compare the five-year return between the public markets and the private equity markets. I’m going to “lose my religion” so to speak as I’m going to compare five year returns in the private equity market measured by an IRR with five year returns in the public markets using a time-weighted non-cashflow derived public market return.

To construct this series, I’ve plotted five-year trailing private equity returns (venture combined with buyouts) with five year returns of the S&P 500. By simple inspection the high degree of “correlation” is fairly obvious Does this provide any insight into our question of returns convergence phenomenon we observed in the first chart.

From inspection, historically, the private equity and public market returns have always had some degree of “correlation” so it’s not obvious that the public markets would have a different effect on private equity and venture capital convergence.

It’s impossible to miss in this diagram that private equity (venture combined with buyouts) has always dominated public market returns over this trailing five year time period. Don’t read too much into that as we are using two different measures to compare these returns but the correlated pattern is remarkable.

We will continue to research this convergence and counter-cyclicality to see if it will again surface or will it simply converge as the markets become more efficient.

What are your thoughts? Any thoughts or insight into the relationship between buyouts and venture capital returns.

Jesse

interesting. I think what is converging is the strategies of the two types of firms. LBO firms are moving towards growth equity and large established venture firms who now have to move $15-25 MM per investment are moving into the space as well. Thats a short way of saying that “VC” firms will soon start earning commoditized returns as well. The big multiple returns still lie in earlier stage VC — which is getting substantial markups in later stage rounds as well being given the opportunity to derisk their investments. Best ghs